What does renters insurance cover? Exploring various renters insurance coverage is a good option in selecting the best renters insurance that suits you. Before purchasing any insurance policy, the need for better understanding of what it covers and what it does not cover is required. This gives you an insight into what coverage will be included in your policy. Understand that renters insurance is different from landlord insurance and will not only offer you renter insurance when you rent an apartment or room.

The difference between renters insurance and landlord insurance is that the coverage includes property that includes insurance for the building and not your personal property. For instance, if your item was stolen, the landlord will not be responsible to cover the loss of the item. But with a renters insurance policy coverage, the insurance company will pay for the replacement of your belongings and not the landlord.

Initially, renters insurance is not mandatory like auto insurance, but most landlords require renters insurance before you can rent an apartment or room. Hence, in your renters insurance policy, you need to know what it covers and what it does not cover. This will determine whether they will be a need for optional renters insurance coverage.

What is renters insurance?

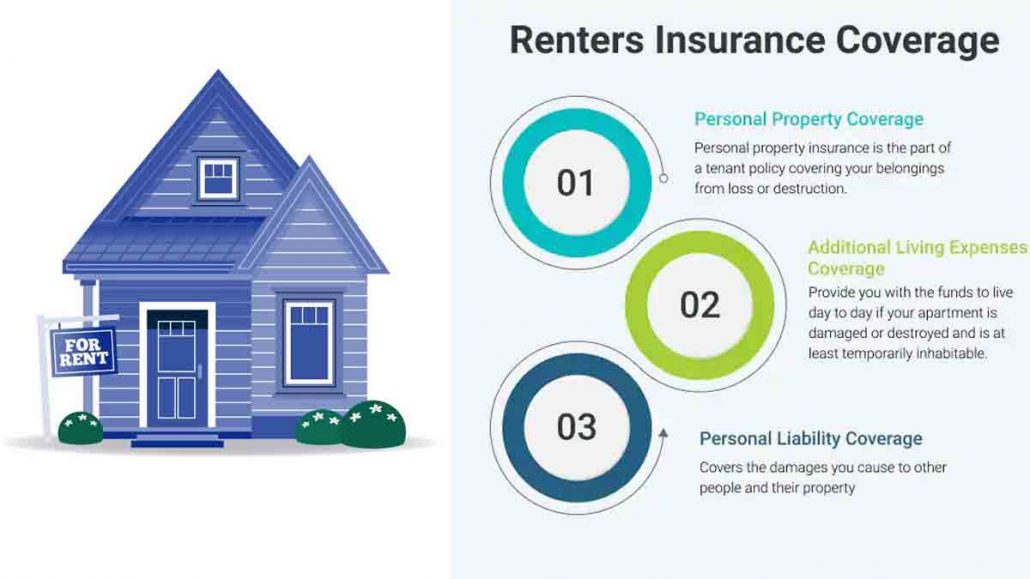

Renters insurance is a type of insurance that cover your personal belongings in case of any unforeseen event including theft, fire, and other disasters. Similar to the way insurance works, it helps to cover the expense of the items if you’re used for causing harm to others. A genuine renters insurance policy includes three types of coverage that not only protect your personal belongings. But also you can your living arrangement after a covered loss.

Renters insurance can also be called tenants insurance or an HO-4 policy, and have the same policy as homeowners insurance, only that it is meant for people who do not own their own place. Also, renter insurance is affordable compared to homeowners insurance and costs about $14 a month.

What does renters insurance cover?

Just like I mentioned earlier, a genuine renters policy includes three types of coverage. But we will be providing you with four types of coverage including a standard renters policy. This includes:

Personal property

You will be covered for the loss of items and other personal belongings due to unforeseen events that include the following:

- Fire or lightning

- Windstorm or hail

- Theft

- Vandalism or malicious mischief

- Volcanic eruption

- A falling object

- Smoke

- Riot or civil commotion

- Explosion

- Damage caused by vehicles

- Damage caused by aircraft.

- The weight of ice, snow or sleet, and more.

Liability coverage

Another coverage that renters insurance offers is liability coverage. This helps in protecting you from financial loss if as a result someone gets injured on your property and visa versa. Let’s take, for instance, your guest slips and fall in your apartment, and the person decides to sue you for medical expenses. However, you don’t have to worry about covering the medical bill as your renters insurance will take care of the cost.

Additional living expenses coverage

Perhaps something unfortunate resulted in you leaving your apartment because it became unlivable due to a covered loss like fire or server storm damage. With your renters insurance policy, you don’t have to pay for living in another place as your policy covers your additional living expenses some of which include temporary accommodation, meals, and other necessary expenses.

Theft and vandalism coverage

Your renters insurance policy also includes coverage for theft and vandalism. For instance, if someone breaks into your apartment and steals your personal belongings or damages your property, your insurance covers the cost by providing you with financial protection.

Natural disasters coverage

Just as the policy covers common perils such as fire and theft, it also offers coverage for natural disasters. Actually, this varies on your policy, some might offer coverage for natural disasters like windstorms, hail, lightning, and more. While some might only include floods and earthquakes, you might be required to purchase separate policies or endorsements.

Loss of use

If you can’t live in your home due to any of the following events mentioned above and you have to stay in a hotel. Your renters insurance policy will cover your expenses such as hotel bills, restaurant meals, and other costs.

Coverage for water damage

Water damage is significant in any renter insurance policy. It offers coverage for water damage which help to cover the costs of repairs and replacing damaged belongings regardless of the situation whether the damage resulted from a burst pipe or a faulty appliance or a leaking roof.

Coverage for fire damage

If peradventure there was a fire outbreak that destroy your rented property and your belongings. Renters insurance includes fire damage coverage that helps to cover the cost of replacement or repair of damaged items and also temporary housing if needed.

Pet-related incidents coverage

If you have a pet, you might be wondering does renter insurance covers pets also. While coverage may vary, there are policies that include pet-related incident coverage which is known as liability coverage.

Common exclusions in renters insurance policies

Almost all insurance policy including auto insurance does not cover everything. However, there are some aspects that renter insurance does not cover. Here are the following things that your insurance policy won’t pay for:

- Flood damage

- Earthquake damage

- Infestations

- Your roommate’s belongings.

If the following events cause damage to your personal belongings or property, your policy won’t cover the expenses for the damage or loss of items.

Benefits of having renters insurance

Now, that you have explored the coverage includes renters insurance, and not is not included. Let’s dive into some benefits it offers tenants like you.

- It protects your personal belongings.

- With liability protection and peace of mind, you don’t have to worry about having to spend money on medical bills if someone gets injured on your rented property or you accidentally injured someone.

- It’s an affordable, and cost-effective way to financially protect your belongings and yourself. Lots of insurance companies offer you a wide range of policy options that you can customize to your preference and budget.

- Importantly it helps to pay for additional living expenses if as a result, your apartment is inhabitable due to fire or severe water damage.

Factors to consider when choosing renters insurance

First of all, before purchasing renters insurance, you need to choose which is the best among the wide range of insurance companies we have. Here are some of the tips to help in narrowing down the right insurance policy best for you:

- Coverage limits: estimate the worthiness of your personal belongings and select the right coverage limit that adequately protects your belongings.

- Deductibles: read and understand the deductible you have in your policy. a higher deductible equals lower premiums, but this comes with the price of paying more out of pocket.

- Additional coverage: check if you need additional coverage for expensive items like jewelry, artwork, or electronics that might be above the normal policy limits.

- Discount: ask about available discounts. Most insurance providers offer multi-policy discounts or reduced rates when you have a safety feature installed in your apartment.

- Policy exclusions: inquire about any exclusions or limitations in your policy.

When you take note of these following factors and also inquire more from an experienced insurance agent, you can get the best policy that you need.

How to file a claim for renters insurance

If you do experience a loss, and you need to file for a renters insurance claim, this is very simple. here are some of the tips your need:

- Firstly, ensure that you document the damage or loss thoroughly

- Take photos or videos

- Keep receipts for any damaged items

- Make sure to file your claim as soon as possible

In addition, you can work with your insurance provider for better insight into the claims process and any requirements to start your claim.

FAQs

Does renters insurance cover theft?

Yes, your renters insurance policy also includes theft of your personal belongings even if you were not at home. For instance, if you lost your phone or it was stolen from your pocket. You are covered by the insurance company to pay for your loss.

Does renters insurance cover water damage?

Yes, renters insurance covers water damage, but it actually depends only if the cause of the water damage is a peril included in your policy. For example, if due to a burst pipe your property got damaged. You will have coverage, but if due to flood, you won’t.

Does renters insurance cover theft from car?

However, if your car was stolen, you need to file a claim under the auto insurance company insuring your car and not your renter policy. But if any items were stolen in your car like laptops and others. Then it will be covered by your renters policy.

Does renters insurance cover storage units?

Yes, renters insurance covers a storage unit. Similar to the fact that your renters policy protects your personal property while you travel. It also offers protection when you place your belongings at your friend’s place or somewhere besides your home.

Does renters insurance cover broken windows?

Yes, renters insurance covers broken windows, but it depends. For instance, if your bedroom window was broken due to a falling object like a falling tree branch in a strong wind, then you’re covered. But if caused due to some play by doing catch and fetch with your dog, it does not cover.

Does renters insurance cover pet damage?

These vary on your coverage and also the type of damage. For instance, if your dog goes playing in your neighbor’s house and mistakenly knocks over a valuable item with his tail, you should be covered by liability insurance. But if it was damaged by its fluffy claws. Then you would have to pay for damages. If your policy includes pet damage coverage, you’re covered.

Does renters insurance cover dog bites?

Yes, renters insurance cover dog bites on someone outside your household. Your insurance policy will pay for the medical bills. But some insurance companies do not include dog bite coverage. This is because of certain breeds of animals that have a history of aggression.