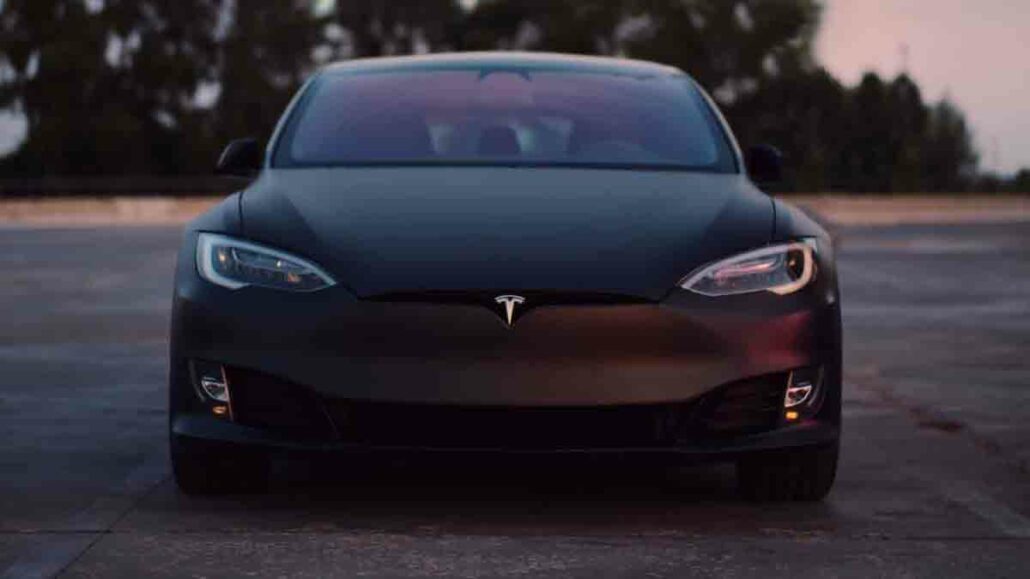

Tesla, a pioneer in electric vehicles, has redefined the automotive industry with its innovative technology and sleek designs. As Tesla ownership grows, so does the demand for tailored insurance coverage. An insurance quote for Tesla is a crucial step in protecting this significant investment. It involves assessing factors such as the vehicle’s model, location, driver’s profile, and desired coverage levels to determine the appropriate premium.

With Tesla’s advanced safety features and potential for higher repair costs, understanding insurance options becomes essential. By comparing quotes from various providers, Tesla owners can find the best balance of coverage and affordability. The keyword “Insurance Quote for Tesla” reflects the growing interest in securing suitable protection for these high-performance electric vehicles.

What is Tesla Insurance?

Tesla Insurance is a unique auto insurance product offered by Tesla, specifically designed for owners of Tesla electric vehicles. It leverages the advanced technology and safety features of Tesla cars to provide competitive rates and comprehensive coverage.

How Tesla Insurance Works

Tesla Insurance collects data from the car’s sensors and cameras to analyze driving habits, such as acceleration, braking, and turning. This information helps determine the insurance premium, rewarding safe drivers with lower rates. In case of an accident, Tesla Insurance provides coverage for repairs, medical expenses, and other related costs.

Note: The availability of Tesla Insurance may vary by location, and specific coverage options and pricing can change. It’s essential to compare Tesla Insurance with other auto insurance providers to find the best fit for your needs.

Is Tesla Insurance Right for You?

If you own a Tesla and value a personalized insurance experience that could potentially save you money, Tesla Insurance is worth considering. However, it’s essential to compare rates and coverage options with traditional insurance providers to determine the best fit for your needs.

Factors Affecting Tesla Insurance Costs

Several factors influence the cost of insuring your Tesla:

- Vehicle Model and Trim Level: Higher-end Tesla models typically command higher insurance premiums due to their value.

- Driver’s Profile: Your driving history, age, location, and credit score significantly impact your insurance rates.

- Coverage Levels: The extent of your coverage, including deductibles and limits, determines your premium.

- Additional Features: Tesla’s advanced safety features, such as Autopilot, can influence your insurance cost.

- Location: Geographic location plays a role in insurance rates due to factors like theft rates and accident frequency.

Finding the Best Insurance Quote

To secure the most competitive insurance quote for your Tesla, consider the following steps:

- Compare Multiple Quotes: Obtain quotes from various insurance providers to find the best deal.

- Leverage Discounts: Take advantage of available discounts, such as safe driver, good student, or multi-car discounts.

- Understand Coverage Options: Familiarize yourself with different coverage types to ensure adequate protection.

- Consider Tesla Insurance: Evaluate Tesla’s insurance offering, which may provide specific benefits for Tesla owners.

Essential Coverage for Tesla Owners

While specific coverage needs vary, consider the following options:

- Liability Coverage: Protects you from financial responsibility for injuries or property damage caused to others.

- Collision Coverage: Covers damage to your Tesla in a collision, regardless of fault.

- Comprehensive Coverage: Protects against losses from theft, vandalism, natural disasters, and other incidents.

- Uninsured/Underinsured Motorist Coverage: Provides protection if you’re involved in an accident with a driver who lacks or has insufficient insurance.

How to Get a Tesla Insurance Quote

Obtaining an insurance quote for your Tesla is a straightforward process. Tesla owners have the convenient option of getting a quote directly through the Tesla app. By providing the necessary details such as your driver’s license information and vehicle details, you can quickly receive a customized quote. This streamlined approach allows for efficient comparison of coverage options and potential cost savings.

Alternatively, traditional insurance providers also offer coverage for Tesla vehicles. To get a quote from these companies, you can visit their websites, contact them directly, or work with an insurance agent. When requesting a quote, be prepared to provide specific information about your Tesla model, its safety features, and your driving history. By comparing quotes from various providers, you can ensure you find the best insurance plan to protect your Tesla investment.

Frequently Asked Questions (FAQs)

Is insurance more expensive for Tesla compared to other luxury cars?

Tesla insurance costs can vary depending on several factors, including model, location, and driver profile. While Tesla models are often high-value vehicles, their advanced safety features might offset some of the cost.

Can I use Tesla’s Autopilot feature to lower my insurance premium?

Some insurance companies offer discounts for vehicles equipped with advanced safety features. However, the impact on your premium may vary.

What happens if I damage my Tesla’s battery?

Comprehensive coverage typically covers damage to your Tesla’s battery, including incidents like fire or theft.

Can I get a discount if I bundle my Tesla insurance with other policies?

Many insurance companies offer discounts for bundling multiple policies, such as home or renters insurance.

How can I lower my Tesla insurance premium?

To potentially lower your premium, consider increasing your deductible, improving your driving record, and shopping around for the best rates.