Looking for a personal loan to consolidate debt, finance a home improvement, or cover an unexpected expense? SoFi Personal Loan could be an option for you. They offer:

- Competitive Rates: SoFi boasts fixed rates as low as 8.99% APR, but keep in mind this is with autopay and direct deposit discounts, and your actual rate will depend on your creditworthiness.

- Flexible Loan Amounts: Borrow from $5,000 to $100,000 to fit your needs.

- Fast Funding: SoFi can fund your loan as soon as the same day you apply if approved.

However, it’s important to compare rates and terms from multiple lenders before making a decision. Additionally, SoFi Personal Loans cannot be used for educational expenses. Considering a Sofi personal loan? Get all the details you need including reviews, and how to apply online in 2024.

What are SoFi Personal Loans?

SoFi Personal Loans are unsecured, fixed-rate loans offered by the online financial services company SoFi. This means:

- Unsecured: Unlike a mortgage or car loan, you don’t need to put up any collateral (like a house or car) to secure the loan.

- Fixed-rate: The interest rate you’re offered stays the same throughout the loan term, providing predictability in your monthly payments.

SoFi Personal Loans are known for their competitive interest rates, no fees (origination, prepayment, or late), and potentially fast funding (as soon as the same day). They can be used for various purposes, including:

- Debt consolidation

- Home Improvement

- Medical bills

- Major purchases

- Unexpected expenses

However, it’s important to remember that SoFi Personal Loans still involve borrowing money and accruing interest. It’s crucial to carefully consider your financial situation and compare options before committing to any loan.

Who is SoFi Personal Loan Right For?

SoFi Personal Loans might be a good fit if you:

- Have good to excellent credit: SoFi generally targets borrowers with good credit scores (typically 680 or higher) to qualify for their competitive rates.

- Have a stable income: Lenders want to make sure you can comfortably afford the repayments.

- Want competitive rates and no fees: SoFi is attractive due to its competitive interest rates and the absence of origination, prepayment, or late fees

- Need flexibility in loan amounts and terms: SoFi offers loan amounts from $5,000 up to $100,000 with various repayment terms.

- Prefer a streamlined online process: If you’re comfortable with technology, SoFi’s online application and potential for fast funding might appeal to you.

Features and Benefits of SoFi Personal Loans

Competitive Rates

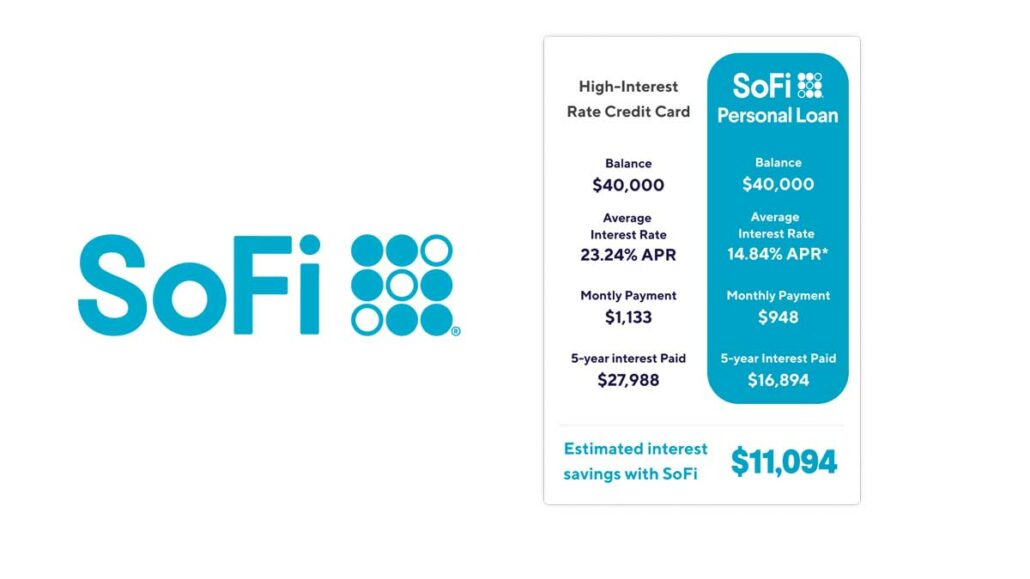

SoFi boasts competitive fixed interest rates, potentially lower than traditional banks or credit cards, which can save you money on borrowing costs.

No Fees

Unlike some lenders, SoFi doesn’t charge origination fees, prepayment penalties, or late fees (though late payments may still negatively impact your credit score). This can translate to more savings and a more transparent loan experience.

Flexible Loan Amounts and Terms

SoFi offers loan amounts ranging from $5,000 to $100,000, allowing you to borrow what you need for various purposes. Additionally, you’ll have flexible repayment terms to choose from, giving you control over your monthly payments.

Fast Funding

In some cases, SoFi can fund your loan as soon as the same day your application is approved, providing quick access to the money you need.

Additional Perks

SoFi offers some unique benefits not typically found with traditional personal loans, such as:

- Career coaching: Get access to complimentary career coaching and financial planning guidance from SoFi professionals.

- Unemployment protection: If you lose your job, SoFi may offer temporary assistance with your loan payments.

- Member discounts: Enjoy potential discounts on estate planning services through SoFi’s partnership network.

Overall, SoFi Personal Loans cater to borrowers seeking a convenient, transparent, and potentially cost-effective way to borrow money. However, it’s crucial to remember that borrowing any money involves additional costs. It’s essential to assess your financial situation, compare options, and understand the terms before committing to any loan, including one from SoFi.

SoFi Personal Loan Requirements

When considering a SoFi personal loan, it’s important to understand the key requirements.

- Credit Score: SoFi generally prefers borrowers with good to excellent credit. A credit score of 670 or higher is often recommended. Having a higher credit score can significantly increase your chances of getting approved and securing a lower interest rate.

- Income and Employment: SoFi requires proof of a stable income. This can include:

- Employment verification (pay stubs, W-2s)

- Other income sources (alimony, Social Security benefits)

They may also require that you have an employment offer that will begin within 90 days.

- Debt-to-Income Ratio (DTI): A lower DTI is favorable. SoFi, like many lenders, prefers a DTI of 36% or less. This indicates that you have a healthy balance between your debt and income.

- Residency: You must be a U.S. citizen or a permanent resident. SoFi also considers nonpermanent residents with proper documentation.

- Documentation:

- Be prepared to provide:

- Government-issued ID (driver’s license, passport)

- Proof of address (utility bill, lease agreement)

Important Considerations:

- Loan Terms and APR: Your actual loan terms, including APR, will depend on your creditworthiness, income, and other factors. SoFi offers rate discounts for autopay and direct deposit.

- Prequalification: SoFi allows you to prequalify for a loan, which involves a soft credit check that won’t impact your credit score. This allows you to see potential rates and terms before a formal application.

To get the most up-to-date and personalized information, I recommend visiting the official SoFi website or contacting their customer service.

How to Apply for a SoFi Personal Loan

Applying for a SoFi Personal Loan is a straightforward process that can be done entirely online:

1. Prequalify

Head to SoFi’s website and navigate to the “Personal Loans” section. You can prequalify for a loan in minutes with a soft credit check that won’t affect your credit score. This step gives you an estimated interest rate and loan terms without any commitment.

2. Review and Choose Your Loan Terms

Once pre-qualified, you can review the offered loan details, choose your desired loan amount and repayment term within the available options, and proceed with the formal application.

3. Complete the Application

The online application process requires basic information like your name, address, employment details, and income. You’ll also need to provide documentation to verify your identity and income, such as pay stubs and tax returns.

4. Sign and Receive Funds

If approved, SoFi will present the final loan agreement for your electronic signature. Once signed and verified, SoFi can potentially fund your loan as soon as the same day, depending on the time of approval and verification.

Remember, before applying, it’s crucial to:

- Review your credit score: Aim for a good to excellent credit score (typically in the 680 or higher range) to qualify for the best rates.

- Shop around and compare rates: Don’t assume SoFi offers the absolute best rate for your situation. Consider comparing rates from multiple lenders to ensure you’re getting the most competitive offer.

- Understand the terms and conditions: Carefully review the loan agreement details, including the interest rate, repayment terms, and any potential fees before committing to the loan.

By following these steps and carefully considering your financial situation, you can determine if applying for a SoFi Personal Loan is the right financial decision for you.

FAQ

What can I use a SoFi personal loan for?

You can use a SoFi personal loan for various purposes, including debt consolidation, home improvement, major purchases, medical expenses, and more.

Does checking my rate with SoFi affect my credit score?

No, checking your rate with SoFi’s pre-qualification tool uses a soft credit inquiry, which does not impact your credit score.

How long does it take to get approved for a SoFi personal loan?

The approval process can vary, but typically, you can receive a decision within a few days. Funding can be received within a few business days after approval.

Does SoFi charge any fees for personal loans?

SoFi does not charge origination fees or prepayment penalties.

What is the minimum credit score required for a SoFi personal loan?

While SoFi doesn’t specify a minimum credit score, a credit score of 680 or higher is generally preferred.

Can I pay off my SoFi personal loan early?

Yes, you can pay off your SoFi personal loan early without any penalties.

What is SoFi’s unemployment protection program?

SoFi offers a member unemployment protection program that allows you to pause payments if you lose your job. Eligibility and specific terms apply.

How do I contact SoFi customer support?

You can contact SoFi customer support via phone, email, or live chat through their website.

Are SoFi loans fixed or variable rate?

SoFi personal loans are fixed rate loans.

Can I get a loan if I am self employed?

Yes, you can get a loan if you are self-employed, but you will need to provide documentation to prove your income.