In today’s competitive world, providing quality education for our children is more important than ever. State Farm 529 plans offer a smart and effective way to save for your child’s future educational expenses. This comprehensive guide will walk you through everything you need to know about State Farm 529, from its advantages to how to get started.

The Savings Plan is a tax-advantaged education savings plan that can help you save for the cost of higher education. It is offered by the Nebraska Educational Savings Plan Trust and managed by Union Bank & Trust Company.

Anyone can open a State Farm 529 Savings Plan, regardless of age, income, or state of residence. You can also contribute to an SF529 Savings Plan for a beneficiary of any age, including yourself.

When you contribute to an SF529 Savings Plan, your contributions grow tax-deferred. This means that you don’t have to pay taxes on the earnings of your account until you withdraw the money. Withdrawals from a State Farm 529 Savings Plan are also tax-free, as long as they are used for qualified education expenses.

Qualified education expenses include tuition and fees, room and board, books and supplies, and computers. You can also use SF529 Savings Plan funds to pay for K-12 tuition and certain apprenticeship fees.

The SF529 Savings Plan offers a variety of investment options, including age-based portfolios and static portfolios. You can also choose to invest in individual funds.

The Savings Plan has no monthly maintenance fees, and the investment fees are competitive. There is also a $25 annual fee for each account that has less than $500 in it.

What is a State Farm 529 plan?

A State Farm 529 plan is a type of education savings account that offers tax advantages to help you save for college. It is named after Section 529 of the Internal Revenue Code, which created these plans.

State Farm 529 plans are offered by individual states, but you can contribute to any state’s plan, regardless of where you live. The plan is offered by the Nebraska Educational Savings Plan Trust.

Anyone can open a SF529 plan, regardless of age, income, or state of residence. You can also contribute to a State Farm 529 plan for a beneficiary of any age, including yourself.

When you contribute to an SF529 plan, your contributions grow tax-deferred. This means that you don’t have to pay taxes on the earnings of your account until you withdraw the money. Withdrawals from a SF529 plan are also tax-free, as long as they are used for qualified education expenses.

Qualified education expenses include tuition and fees, room and board, books and supplies, and computers. You can also use plan funds to pay for K-12 tuition and certain apprenticeship fees.

The plan offers a variety of investment options, including age-based portfolios, static portfolios, and individual funds. You can also choose to invest in a mix of different investment options.

It has no monthly maintenance fees, and the investment fees are competitive. There is also a $25 annual fee for each account that has less than $500 in it.

If you are looking for a tax-advantaged way to save for college, the State Farm 529 plan is a good option to consider. It offers a variety of investment options, low fees, and tax advantages.

Benefits of State Farm 529 plans

The following are some of the benefits of State Farm 529 plans:

Tax benefits

Contributions to a SF529 plan grow tax-deferred, and withdrawals are tax-free, as long as they are used for qualified education expenses. This means that you can save money on taxes both now and in the future.

Flexibility

Anyone can open a State Farm 529 plan, regardless of age, income, or state of residence. You can also contribute to the plan for a beneficiary of any age, including yourself. This makes it a good option for families with children of all ages.

Investment options

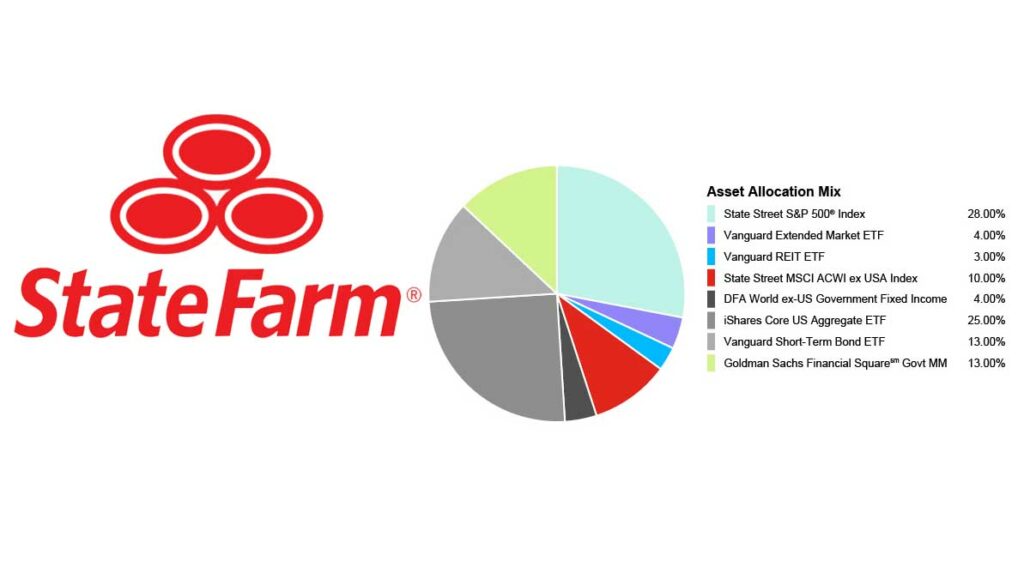

The SF529 plan offers a variety of investment options, including age-based portfolios, static portfolios, and individual funds. This allows you to choose the investment strategy that is right for you and your family.

Low fees

The State Farm 529 plan has no monthly maintenance fees, and the investment fees are competitive. This means that you can keep more of your savings for your child’s education.

Portability

You can transfer your State Farm 529 plan to any other state’s 529 plan without tax penalties. This gives you peace of mind knowing that you can still save for your child’s education even if you move to another state.

Types of State Farm 529 plans

The State Farm 529 Savings Plan is a college savings plan that offers two types of investment options: age-based portfolios and static portfolios.

- Age-based portfolios are designed to automatically adjust the asset allocation as the beneficiary gets closer to college age. This means that the portfolio will become more conservative over time to reduce risk.

- Static portfolios offer a fixed asset allocation that remains the same throughout the investment period. This means that the portfolio will not automatically adjust as the beneficiary gets closer to college age.

You can also choose to invest in a mix of age-based and static portfolios. This can be a good option if you want to have more control over your investment strategy.

In addition to the two types of investment options, the SF529 Savings Plan also offers a Bank Savings Static Option. This option is a good choice for families who are looking for a safe and conservative investment option.

How to open a State Farm 529 plan

To open a State Farm 529 plan, you can visit the State Farm website or contact a State Farm financial advisor.

To open an account online, you will need to provide the following information:

- Your personal information, such as your name, address, and date of birth

- The beneficiary’s personal information, such as their name, address, and date of birth

- Your Social Security number or Taxpayer Identification Number

- The beneficiary’s Social Security number or Taxpayer Identification Number (optional)

- Your bank account or debit card information to make a contribution

Once you have provided all of the required information, you will be able to review and submit your application. The State Farm 529 Savings Plan team will then review your application and contact you if they have any questions.

If you are approved to open an account, you will need to make a minimum initial contribution of $25. You can then make additional contributions at any time and in any amount.

How to invest in a State Farm 529 plan

To invest in a State Farm 529 plan, you can follow these steps:

- Open a SF529 plan. You can do this online or by contacting a State Farm financial advisor.

- Choose an investment option. The SF529 offers a variety of investment options, including age-based portfolios, static portfolios, and individual funds. If you are not sure which investment option is right for you, you should consult with a financial advisor.

- Make a contribution. You can contribute to your SF529 plan at any time and in any amount. You can make contributions from your paycheck, bank account, or credit card.

- Invest your contributions. Your SF529 plan will invest your contributions based on the investment option you have chosen.

- Monitor your investment. You can monitor your investment online or by contacting a State Farm financial advisor.

How to withdraw from a State Farm 529 plan

To withdraw from a SF529 plan, you can follow these steps:

- Log in to your State Farm 529 plan account online.

- Click on the “Withdrawals” tab.

- Select the type of withdrawal you want to make: qualified or non-qualified.

- Enter the amount of money you want to withdraw.

- Review your withdrawal request and click “Submit.”

Qualified withdrawals are used for qualified education expenses, such as tuition and fees, room and board, books and supplies, and computers. Qualified withdrawals are tax-free.

Non-qualified withdrawals are used for non-qualified expenses, such as personal expenses or to pay off student loans. Non-qualified withdrawals are subject to ordinary income tax and a 10% penalty on the earnings portion of the withdrawal.

Once you have submitted your withdrawal request, State Farm will process your request and send the money to you or the educational institution. The processing time for withdrawals is typically 3-5 business days.

Compare SF529 plans to other 529 plans

State Farm 529 plans are comparable to other 529 plans in terms of features and benefits. However, there are some key differences to be aware of.

Investment options

State Farm 529 plans offer a variety of investment options, including age-based portfolios, static portfolios, and individual funds. Other 529 plans may offer a similar selection of investment options, but some may offer more or fewer options.

Fees

SF529 plans have low fees, with no monthly maintenance fees and competitive investment fees. Other 529 plans may also have low fees, but some may have higher fees.

Tax benefits

SF529 plans offer the same tax benefits as other 529 plans. Contributions to a State Farm 529 plan grow tax-deferred, and withdrawals are tax-free, as long as they are used for qualified education expenses.

State residency

State Farm 529 plans are available to residents of all states. However, some states offer tax breaks for residents who contribute to their state’s 529 plan.